The combination of customer-driven digital priorities and relentless technology innovation are driving an explosion in the financial technology (fintech) market. This burgeoning segment includes lending, personal finance, payments, remittances, transaction processing, and more.

Given the advancements in underlying fintech technology, combined with customers’ rapidly advancing expectations, the digital mandate for fintech is real-time.

Real-time transactions. Real-time loan approvals. Real-time payments. It doesn’t matter if we’re using our phones or our computers or if we’re in a store, bank branch, or automobile dealership, we want our transactions and payments and loans to take place properly right now.

For an industry used to laborious, time-consuming loan origination processes, end-of-day settlements, and monthly billing cycles, this need for speed raises the bar – on the technology to be sure, but also on the end-to-end business processes and the human interactions at the core of every financial business.

Drilling Down to Business Insights in Real-Time

Regardless of how complex the underlying technology infrastructure becomes, if there’s a problem, the business needs to know about it – and fast. Furthermore, it must be able to drill down to the underlying root cause of any issue in real-time, before small problems become large ones.

Anodot can help. Anodot provides a real-time analytics and automated anomaly detection system that discovers outliers in vast quantities of data, turning them into valuable business insights.

Using patented machine learning algorithms, Anodot isolates issues and correlates them across multiple parameters in real-time. Furthermore, the platform can analyze any type of data, including ecommerce transactions, IoT telemetry, system logs, and more – all data, all the time, across all metrics.

Traditional analytical processing deals with summary data, yielding delayed and incomplete results. Given today’s real-time digital demands, such traditional approaches are no longer good enough.

In contrast, Anodot can report on errors impacting a specific page, browser, platform, or feature on a page, all in real-time. In fact, Anodot’s true power lies in its ability to analyze all metrics – and all permutations and correlations of metrics – in real-time.

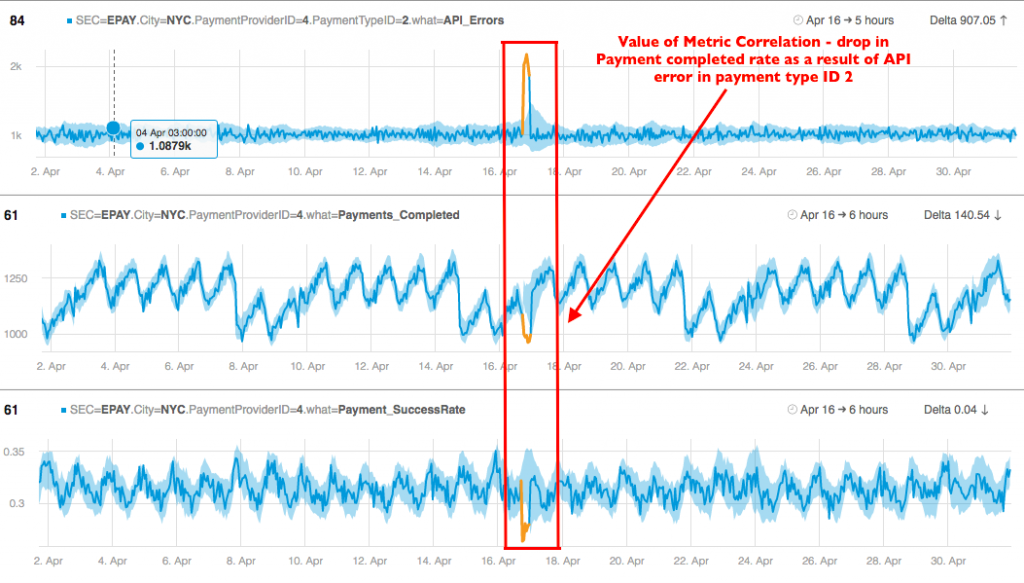

Anodot’s ability to detect correlations among anomalies leads to better root cause diagnoses, as the screenshot below illustrates.

Correlation Across Three Separate Metrics in Real-Time (Source: Anodot)

Correlation Across Three Separate Metrics in Real-Time (Source: Anodot)

In the illustration above, Anodot is monitoring behavior from a specific payment provider in a specific city, correlating unusual behavior in API errors, completed payments, and the payment success rate in real-time, identifying the culprit as an API error for a particular payment type.

Examples of Anodot’s Real-Time Insights in Fintech

Identifying salient business events in general and root causes of problems in particular are important capabilities for any industry – but fintech’s complexity and need for real-time performance make Anodot especially useful. Here are three examples.

Example #1: Major credit card transaction processor

One of the largest credit card transaction processors in the world handles millions of transactions per hour, coming from a wide variety of systems at numerous retailers and other points of sale.

However, because of the arcane data formats that some applications generate, this processor must enrich the data to add relevant metadata and to put the transactions into a modern format – and this enrichment must take place in real-time.

Ensuring that both the raw data feeds as well as the enrichment processes behave properly, therefore, are mission critical priorities for this processor.

Anodot enables it to monitor transaction volume (in dollars) and transaction count in real-time, as well as numerous other relevant parameters. Anodot understands normal patterns for each of these metrics, and thus flags any deviation from normal behavior in real-time, even for metrics pertaining to drill-down queries.

For example, if there’s an unexpected slowdown in transactions from a particular retailer in a particular city, Anodot will flag that issue in real-time.

Example #2: Real-time loan approvals

This auto lender provides a mobile app that enables consumers to apply for car loans and receive their answer on their phones in real-time.

The challenge to enabling such processes is the ability to evaluate and correlate the risk factors in real-time, including credit score, existing loans, and other relevant factors.

If the data on any one of these factors are incorrect or out of date, the provider may approve a loan that they shouldn’t or decline one that they should have approved.

Anodot is able to drill down into the individual criteria the lender uses to make its lending decisions, as well as the correlations across such criteria that impact the behavior of the approval process.

Example #3: Major online payment processor

Online payments are becoming increasingly popular, but consumers are still somewhat dubious about them. Therefore, being able to accurately and consistently make payments is essential to the reputation of the processor – as is the ability to uncover fraud in real-time.

Furthermore, payment processing is at the core of every ecommerce site, so if it goes down, then the problem cascades to the online retailer. The reputation of more than one company is at stake.

Therefore, the processor needs to know right away if there’s a localized problem, before it becomes a broader, systemwide issue.

Anodot is able to identify issues with payment transactions in specific geographies, using specific client technologies, or conforming to other, less obvious metrics – in real-time.

The Intellyx Take

If you look at the three graphs in the diagram above, you’ll notice that the patterns in each of the graphs are different from the others – even though each graph separately exhibits a recognizable pattern.

As humans, we have no problem recognizing the pattern in each graph as such – but for software, pattern recognition is much more difficult. Among Anodot’s most important innovations are the ability to recognize a wide variety of different kinds of patterns – an essential prerequisite to being able to identify any deviations from a pattern.

Other tools that don’t have Anodot’s sophisticated pattern recognition capability will either misidentify behavior consistent with a pattern as anomalous, leading to false positives – or worse, won’t pick up on important anomalies at all.

This ability to identify anomalies to numerous patterns in real-time is essential for Anodot’s ability to recognize the correlations across different data streams – thus differentiating Anodot from each of its competitors.

Copyright © Intellyx LLC. Anodot is an Intellyx client. At the time of writing, none of the other organizations mentioned in this paper are Intellyx clients. Intellyx retains full editorial control over the content of this paper.